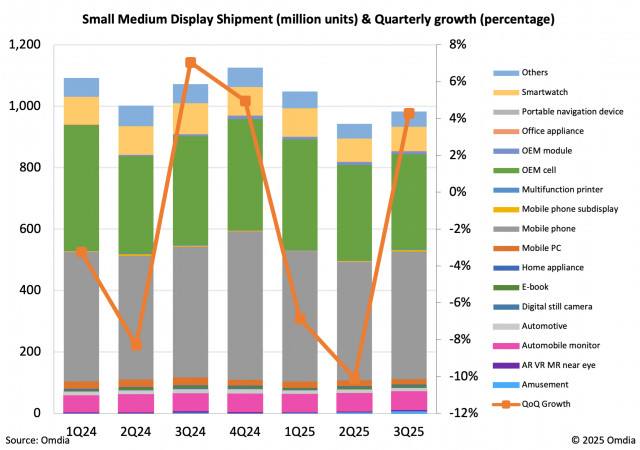

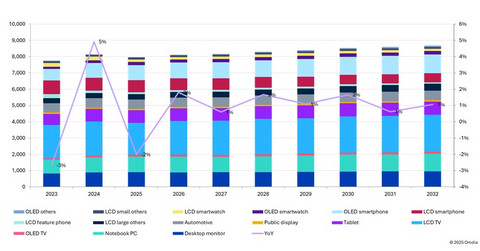

LONDON–(Business Wire / Korea Newswire)–New analysis from Omdia’s quarterly small medium display market tracker reveals shipment will decline by 10% quarter-on-quarter (QoQ) and 6% year-on-year in 2Q25. This downturn is due to business and inventory adjustments among small medium display application device makers, particularly smartwatch and smartphone makers. Tariff risks previously prompted these manufacturers to aggressively build up panel inventories in 4Q24 through 1Q25. However, as tariffs concerns eased in 2Q25, device makers have become more cautious with their purchasing plan, leading to reduced panel shipments.

According to Omdia’s Small Medium Display Market Tracker, small medium display shipments (all displays for under 9-inches) reached 1,048 million units in 1Q25. Of these shipments, AMOLED panels (Active Matrix OLED) accounted for 612 million units, representing 58% market share. Small medium AMOLED panels were primarily shipped for smartphone and smartwatch applications, with smaller volumes going to automotive and game applications. Strong shipments in 1Q25 were driven by inventory build-up efforts and tariff risk management by small medium display applications brands and OEMs, as well as high-capacity utilization among AMOLED panel makers. While smartphones remained exempt from reciprocal tariffs in 1Q25, smartphones made in China faced a 20% tariff when imported to the US. Given that 80% of Apple’s iPhones were assembled in China and 34% of iPhones were shipped to the US, panel inventory preparation of potential tariffs was particularly prominent. Additionally, China’s special consumer electronics subsidy stimulated robust domestic smartphone purchases during the same period.

However, small medium display shipments are expected to decline to 942 million units in 2Q25 due to ongoing inventory adjustments. AMOLED shipments will account for 551 million units maintaining a 58% market share. Mobile phone displays including OEM cell and smart watch display will experience the sharpest declines dropping 14% and 18% QoQ respectively. In contrast, amusement displays will grow significantly by over 100% QoQ due to the launch of new mobile game consoles.

“The small medium display market is traditionally seasonal with the strongest growth typically occurring in the second half of the year. However, the 10% QoQ decline in 2Q25 clearly demonstrates the unique impact of tariff risks and inventory adjustments,” said David Hsieh, Senior Director for Display research in Omdia. “Meanwhile, AMOLED panels have maintained a stable share of 58% of total small medium display shipments, putting increased pressure on , particularly LTPS TFT LCD fab, to sustain their business over the long term. By contrast, shipments of a-Si TFT LCD panels for entry level mobile phones have been stable, encouraging more China LCD makers to produce small medium a-Si TFT LCD panels in their Gen8.5 and Gen8.6 LCD Fabs. We anticipate a return to growth in 3Q25 due to the continued diversification of the small medium display market beyond smartphones into a wider variety of device and applications.”

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250618242100/en/

Website: https://omdia.tech.informa.com/

This news is a press release provided by Omdia.